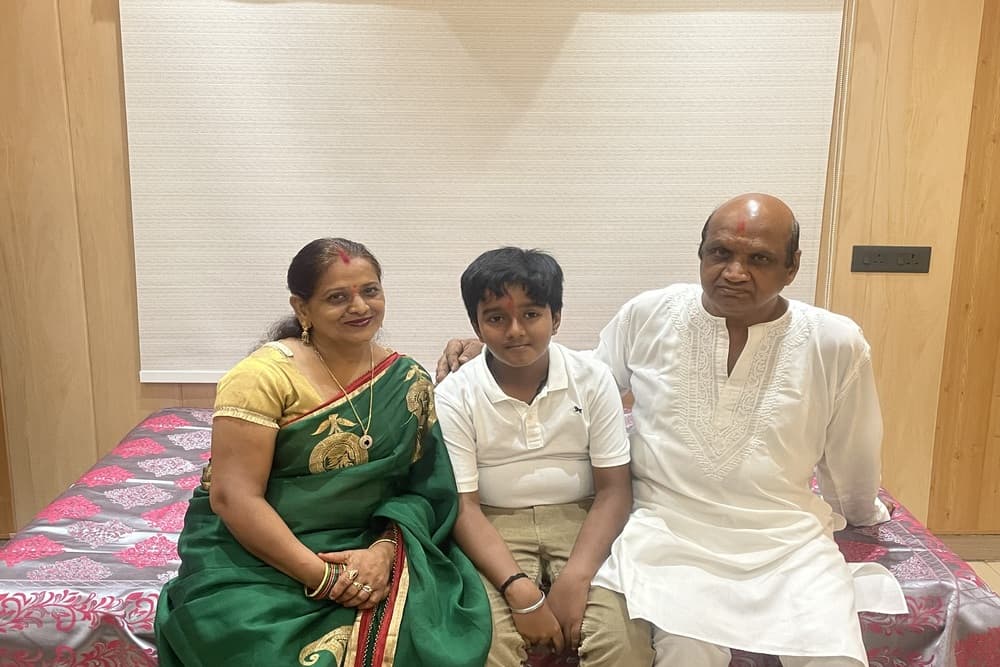

Shashi Kant Gupta, 68, a retired Union Bank of India (UBI) officer, hums his favourite song, “Zindagi ek safar hai suhana”, to sum up his life’s journey thus far. Gupta’s struggles haven’t been any easier or different from many of us, and the song’s lyrics give him the comfort and motivation to look at the brighter side of life during times of crisis. In an interview, Gupta recounts his humble journey from a clerk to a Scale 1 officer at UBI bank, his wife’s death, his second marriage, retirement, and the struggles to keep himself and his family financially secure.

Gupta began his career with the popular daily Dainik Jagran, working in the audit department after graduating from college. In 1978, he got an opportunity to work as a clerk at a UBI bank branch in the small town of Masauli in Uttar Pradesh’s Barabanki district. It was a pivotal moment in his life since it shaped the rest of his work life, finances, family, and other life goals. But in 1987, he was transferred to the Union Bank of India’s branch in Kanpur city, the state’s financial capital, where he continued until his retirement in 2015.

Hailing from a middle-class family, he inherited the savings habits from his parents early on, a practice commonly observed in households from similar socio-economic backgrounds. He maintained that habit of saving money, eventually allowing him to build a house for his family a few years later.

However, in an unexpected turn of events, his wife fell seriously ill in 1997, and she passed away after four years of struggle, leaving behind their two children—a school-going teenage daughter and a college-going son. It was the lowest phase of their lives, says Gupta.

Gupta deliberately avoided job promotions to be close to the family as it would require relocating to another place. “If you are promoted, you will be transferred to another state; due to this reason, I did not take promotion. Many of my friends have retired as branch managers or general managers; I didn’t take a promotion because I didn’t want to disturb the setup of my family,” he says, explaining his position and mental state at the time. Later, he remarried, and after retirement, he continued to live in the same city where he spent his entire work life.

No Planning Is Fool-Proof

Regarding the job promotions he declined to accept, Gupta says, “I think that was not a mistake but a compromise I did for my family.” Fortunately, his sacrifices have borne fruit, as his children are now well-settled. Gupta started small, but he understood the value of little savings regularly. He recalls he was a meticulous planner. “I planned everything: children’s education, their marriage, buying a house and retirement, and have been in the habit of saving,” he says.

Nobody can predict the future, but one must still plan, says Gupta, reflecting on the “few things” he could have done better. Gupta mainly invested in safe instruments, like fixed deposits, the National Saving Certificate, and Kisan Vikas Patra, and rarely in equities. “Sometimes I think I should have taken a little more risk and invested in real estate instead of putting all my money into FDs. I was in (a) safe mode more than required,” he says.

Gupta has no life or health insurance coverage currently. The health coverage provided by the employer ended after retirement, but thankfully, it helped him to get treatment for his wife.

Gupta had bought a medical policy after retirement but recently discontinued it as the premium was high, around Rs 40,000. “I should have taken medical insurance when I was young,” says Gupta, as personal health insurance policies have become unaffordable due to his age.

Conventional Is Comfortable

Gupta uses technology sparingly to manage his money but only to stay connected with his friends, family, and retired colleagues. “Technology helped me stay connected with my old colleagues. I am a part of a WhatsApp group where we are all connected,” he says, but for money matters, he prefers to go to his bank for any banking-related services.

“I don’t trust the digital modes and even don’t prefer using an ATM card. The cheque is always my first choice. I read the news now and then that somebody got cheated, fraudulent withdrawal of money, etc. So, I like the old modes of transaction. Besides, my branch is nearby, and I love visiting it because I get to meet the bank people,” adds Gupta.

Retirement Does Not Mean Being Dependent

Asked if he is dependent on his children, “definitely not”, he says, adding, “I get a pension, and fortunately, I am in good health.” Though he doesn’t have a hobby, he keeps busy with daily household chores. The evenings are special for him when he catches up with retiree buddies. “I never needed a hobby, as my family and friends were always around,” he says.

Motivation Can Help Win Challenges

Gupta is mindful of the changing times. The banking industry itself has undergone a vast transformation even when he was working. “The way banking was done before has changed before me, from manual to digital. I remember when the bank would transfer employees not well-versed with computers to a manually operated branch. I, too, felt it difficult. I would practice on my son’s computer in the evenings. Luckily, I got through the transition phase successfully. My motivation was to stay in this city (Kanpur) with my family.”

As a habit, he still reminds his children of timely investments and to update their knowledge on tax-related matters regularly. His word of wisdom to his children is not to chase money, avoid unnecessary expenses, and show off attitude.