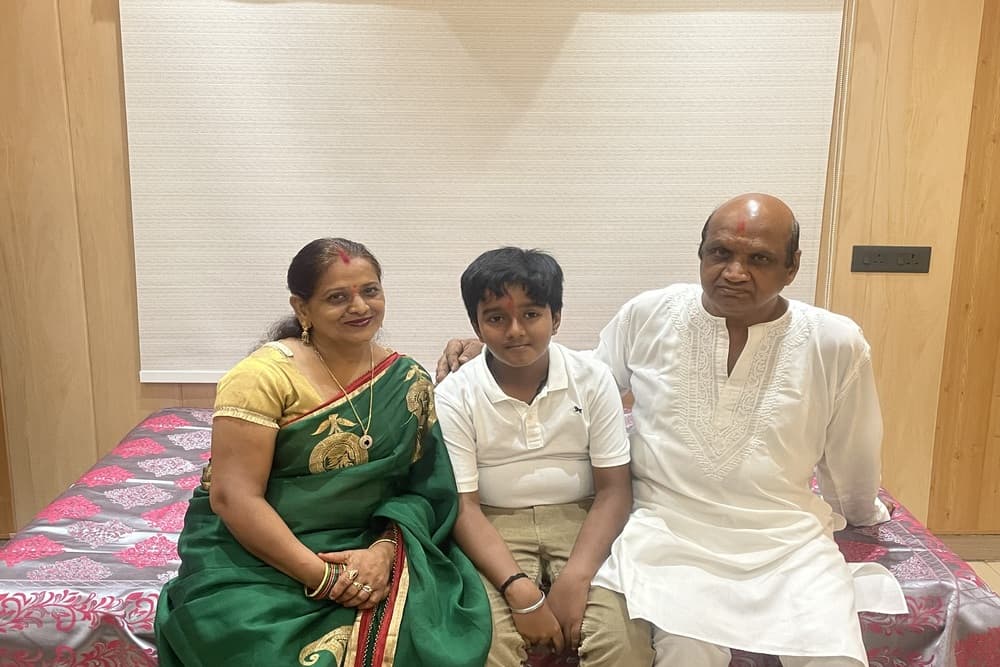

Brahm Singh Saini, 75, hails from Habibpur Sikri, a small village in Uttar Pradesh’s Muzaffarnagar district. Saini’s potential as a bright student didn’t become known until he secured admission to the prestigious University of Roorkee, now IIT-Roorkee, in 1968, surprising everyone, including his family and friends.

He settled in Noida after retirement in 2008, but he remained socially active by joining various clubs. He is also the founder chairman of NCR Engineers Forum, a registered charitable society for retirees from the central and state engineering services.

In a recent interview, he recounted his life’s journey from childhood to retirement and his financial struggles to secure his family and old age. Unfortunately, Saini has no memory of his father, who passed away when he was very young. His uncle took care of his needs, but he didn’t have much information to guide him in his education. At that time, Saini says, a ‘Patwari,’ or the government official who maintains land records and collects taxes, was considered an educated person. So, when he passed his class 10 exams, he was taken to a Patwari to guide him regarding his higher education, although he wasn’t sure how helpful those suggestions would be.

A few years later, upon joining as a district engineer in Muzaffarnagar district, he was pleasantly surprised to receive a marriage proposal in a letter on the first day of joining work. Saini recalls: “I married a few days before my convocation in November 1972. I went with my wife to receive the degree; everybody congratulated me twice for my two achievements.”

Clearly, Saini’s journey from a small village school to the prestigious IIT has been a significant milestone in his life. So, when he was blessed with two children, a son and a daughter, he ensured they received a good education.

Hard Work, Delayed Retirement And Financial Planning:

Saini says that hard work, planning, and good intentions have been the strengths that helped him grow professionally and personally. He proudly recalls, “I was part of the team constructing the ‘Kalindi Kunj’ barrage when I was posted in Okhla; it was an enviable posting, but I got it, probably due to my work.” Because of the success of this project, he says that even after his retirement, he was perhaps called to serve as an independent engineer for the Commonwealth Games in Delhi in 2010.

He finally left his active work life at 65 in 2012. However, his journey hasn’t been a joy ride all along; he, too, faced financial hardships, which is common in middle-class households. Regarding his investments, Saini says he invested in fixed deposits, post office schemes and some money-back insurance policies. He had also invested in mutual funds during his work life but redeemed them some 7-8 years ago. He also discontinued his medical insurance, for which he was paying Rs 50,000 in premiums annually, as he and his wife are still covered for health expenses by the department.

He explains that he wanted to fulfil all his responsibilities before retirement. “I would think about our pensions, a car, and a house for us; now, I have it all; I want nothing more.” Asked about his preferred mode of transactions, Saini says he feels comfortable using debit and credit cards but not net banking, Paytm, etc.

Life Springs Surprises:

While hard work always pays, life can sometimes spring surprises in the least expected moments. Saini won a plot in his son’s name in Noida through a lucky draw that cost him around Rs 2,400 per square meter, a smaller sum even at the time. “The same plot now costs Rs 2.5 lakh per square meter,” he says. Saini’s son, who was then posted in the US, wasn’t aware of his father’s purchase, for which his father was repaying a loan in equated monthly instalments (EMIs). However, he helped his father repay it when he learned about it. Saini believes that God’s grace helped him reach his goals. “Whatever I thought, I received,” he says.

Mistakes, Lessons, And Life After Retirement:

Saini faced hostile situations when posted in certain places where people threatened him to stop projects. He didn’t compromise with his work, though he could have easily avoided those situations by looking the other way, but the projects would have suffered. Such issues often kept him involved, so he had limited time for his family. Says Saini, “Whether right or wrong, take time to decide, but once you decide, stick to it. I follow this principle and tell my children to do the same because if you are wrong, you will learn from it.” Saini took to golfing to kill the boredom, which he started learning the game six months before his retirement. He has been a golfer since and spends his mornings at the Noida Golf Club. But the evenings are reserved for friends and family.

Stay Connected, Be At Peace

Saini is not financially dependent on his children, but they take care of his finances. In his reply, Saini replies, “Not the least. I rather want to help them.” “I am enjoying the best phase of my life. No pressure or stress; I have friends I can vouch for and will be available within minutes on my one call. We all care for each other and are well-connected,” adds Saini.