Do Seniors Need To Pay Advance Tax And How To Calculate It?

Taxation can seem complex if you don’t stay updated about its rules. Advance taxes can be even more confusing for many people, especially senior citizens.

Taxation can seem complex if you don’t stay updated about its rules. Advance taxes can be even more confusing for many people, especially senior citizens.

Advance Tax

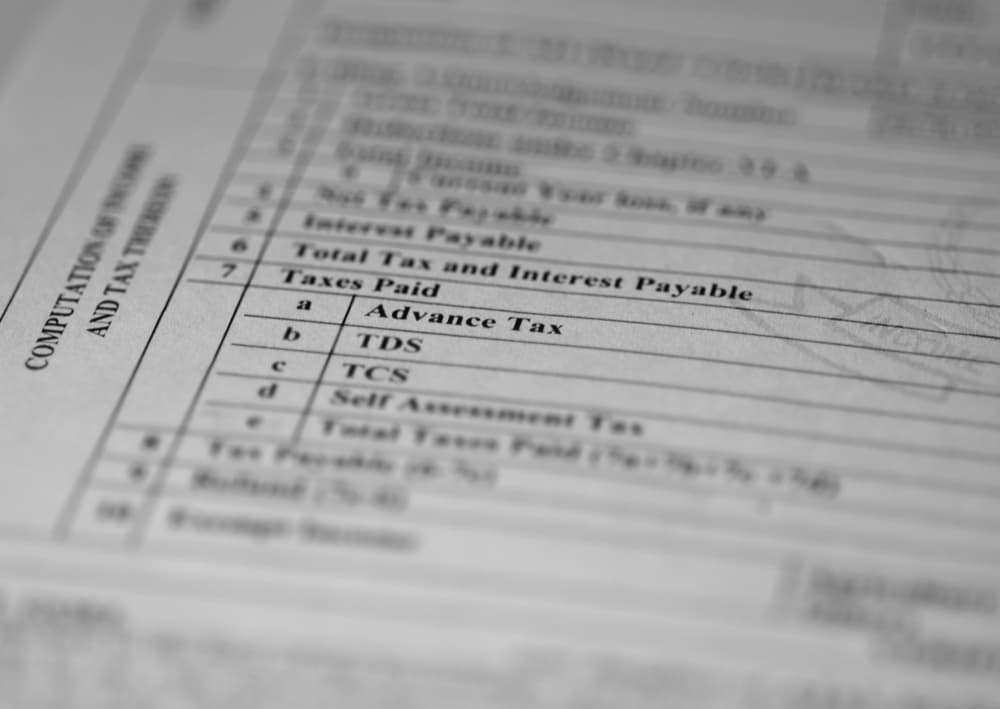

Advance tax or payment of taxes in advance can be quite confusing for many of us. For salaried people, the tax deducted at source (TDS) takes care of advance tax payment requirements. TDS is equivalent to advance tax if you assume taxation as an annual event. The concept of advance tax is not new for businessmen and self-employed people. There is always a question that raises whether Seniors Need To Pay Advance Tax. Let’s find out some important rules related to advance taxation.

Do Seniors Need To Pay Advance Tax? Let’s find out the rules: Any person whose tax liability is expected to exceed Rs 10,000 in a year is liable to pay advance taxes. The Government has stipulated a deadline for each quarter by which people have to pay the advance taxes. But for senior citizens, there are relaxations on the rule. For senior citizens, the following criteria have been given for their eligibility for exemption from advance taxes. So, if a person satisfies the following criteria, he or she is not liable to pay advance taxes.

Advertisement

He or she should be an Indian resident, age must be 60 or above, and does not have any earnings under the gains from business or profession. You do not have to worry about advance tax if you satisfy all the applicable criteria for an exemption.

So, if you are a retiree and earn regular pension income, you do not have to pay advance taxes. The pension income comes after TDS so you do not have to worry about taxes at all unless at the year end. When the year-end arrives, you have to file the returns. Taxation for salaried individuals or retirees who have no other source of income except pension income do not have to worry about advance tax at all.

Advertisement

However, if you earn money through business or by your profession, you should pay taxes in advance. Take the proportion of taxes and the deadline for filing advance taxes seriously and follow the rules. It will keep you tension-free and you will be able to focus on your business or profession without any concern of taxman knocking at your door.

Your tax amount depends on the government policies on tax exemption and the deduction allowed in your case. Make the full use of deduction to lower your tax liability. Business or professional income is very different from income from salary.

To calculate advance tax, you can estimate the expected total income from business and profession for the relevant financial year and deduct all the expenses from it, such as travel expenses, phone bills, etc. Now, add income from other sources except income from salary. If the tax on total income estimation after adjusting the eligible deduction benefits exceeds Rs 10,000, you are liable to pay the advance tax.

It is good to contact a tax expert or CA and get their help in filing taxes.

Also Read: 3 Points That You Must Consider When Investing To Save Taxes

NRI senior citizens are not eligible for the above-mentioned exemption from the advance taxes as they are not residents of India. In their cases, the advance tax has to be filed on any income earned from India.

Finally, these are just a brief guideline. You must contact a CA or tax expert for actual tax filing if you have income from a business or profession and to ensure that tax calculation and its timely payment are done without a mistake.

The author is an independent financial journalist.

Advertisement

Both sections 80CCC and 80C of the Income-tax Act, 1961, allow deductions from the annual income, but the aggregate of the deductions cannot exceed Rs 1.5 lakh.

Every penny counts when it comes to saving money during your retirement. So, tax savings can be crucial for seniors when it comes to saving money and living a financially healthy life.

Section 139 of the Income Tax Act governs the filing of income tax returns by every individual with income above the basic exemption limit.

Get all the latest stories delivered to your inbox

Advertisement

Get all the latest stories delivered to your inbox