How To Plan For Retirement With Fixed-Income Funds?

Fixed-income funds provide stability to your investment portfolio, better cash flow visibility, and help preserve capital.

5 Questions To Ask Yourself Before Planning Your Vacation

Here are a few things to keep in mind before planning your trip to ensure your travel plan is flawless and you have a memorable experience.

Why Average Returns And Sequence Of Returns Are Both Vital For Your Portfolio

It is important to consider the portfolio’s average return and the sequence in which those returns were earned to create a foolproof investment portfolio.

From Top-Ups To Porting, Here Are Some Tips To Reduce Health Insurance Premiums

Many Indians can’t afford health insurance as medical costs rise, leaving them with no choice but to suffer. Here are some tips to reduce health insurance premiums.

75% Of Indians Have A Retirement Plan In Place, 87% Have Health Insurance, Shows Outlook Money-Toluna Survey; Learn More

The online survey threw light on how Indians are preparing for their sunset years and how seriously they take retirement planning.

The online survey threw light on how Indians are preparing for their sunset years and how seriously they take retirement planning.

What Motivates Seniors To Take Up Post-Retirement Jobs, And Are They A Good Hire?

Many seniors want to continue working after retirement, but what opportunities and challenges may they face when seeking reemployment?

Many seniors want to continue working after retirement, but what opportunities and challenges may they face when seeking reemployment?

Insurers Will Be Able To Provide Nuanced Products To Seniors If Insurance Bill Is Approved, Says Vibha Padalkar

Insurers may look for other solutions, such as medicines or equipment for the mobility impaired beyond which policy seniors need once the draft insurance amendment bill is passed.

Insurers may look for other solutions, such as medicines or equipment for the mobility impaired beyond which policy seniors need once the draft insurance amendment bill is passed.

How Retirement Planning Can Help You Quantify Goals And Everything One Needs To Achieve Them

Many people make the mistake of overlooking retirement planning until the later stages of their career, leading to potential financial calamities.

Many people make the mistake of overlooking retirement planning until the later stages of their career, leading to potential financial calamities.

Start Retirement Planning Early For Financial Security In Old Age, Says V. Vaidyanathan

When considering retirement planning, it is crucial to factor in the uncertainties of inflation alongside the inevitabilities of death and taxes, Says Vaidyanathan.

When considering retirement planning, it is crucial to factor in the uncertainties of inflation alongside the inevitabilities of death and taxes, Says Vaidyanathan.

Data Interchange Will Take The Digital Game To Next Level, Says Tapan Singhel

Speed and efficiency are the easier parts of digitisation, but the big benefits are yet to come as data interchange will help develop incredible capabilities to save lives, says Singhel.

Speed and efficiency are the easier parts of digitisation, but the big benefits are yet to come as data interchange will help develop incredible capabilities to save lives, says Singhel.

PFRDA Issues Master Circular For Online Registration Of Atal Pension Yojana

The Pension Fund Regulatory and Development Authority (PFRDA) has consolidated its three previous circulars related to online registration of Atal Pension Yojana. Learn more.

The Pension Fund Regulatory and Development Authority (PFRDA) has consolidated its three previous circulars related to online registration of Atal Pension Yojana. Learn more.

Check Performance, Other Parameters Before Stock Trading; Stick To Large-Caps If You Are Unsure

For retirement planning, diversification of your portfolio is the key to preventing or minimising losses from market volatility; stick to large caps if you are unsure which stocks to pick.

For retirement planning, diversification of your portfolio is the key to preventing or minimising losses from market volatility; stick to large caps if you are unsure which stocks to pick.

Clean Energy, Telecom, Banking Sectors To Watch In 2024, Consumption To Pick Up: Vijay Chandok

Modernization, government spending, increased rural consumption, and improved balance sheets of banks and other vital entities are expected to drive India’s economic growth in 20

Modernization, government spending, increased rural consumption, and improved balance sheets of banks and other vital entities are expected to drive India’s economic growth in 20

Retirement Savings Should Have A ‘Defined Benefit And Contribution’ Approach: Anup Bagchi

Your retirement savings strategy must have a defined benefit and contribution approach to weather the market’s various ups and downs and as a tool to mitigate the risks.

Your retirement savings strategy must have a defined benefit and contribution approach to weather the market’s various ups and downs and as a tool to mitigate the risks.

Mutual Fund Ratings Shouldn’t Be A Buying Factor; Boost Debt Assets For Income, Protection

Investors should gradually reduce their equity exposure and increase debt allocations with age to ensure capital appreciation and steady income; MF ratings shouldn’t be a factor for buying

Investors should gradually reduce their equity exposure and increase debt allocations with age to ensure capital appreciation and steady income; MF ratings shouldn’t be a factor for buying

How Do Debt Funds Benefit Retirees? 5 Advantages You Can’t Ignore

Debt mutual funds hold a significant value to a retirement portfolio as they ensure regular, predictable income for the investors.

Debt mutual funds hold a significant value to a retirement portfolio as they ensure regular, predictable income for the investors.

Evaluate Before Investing In Stocks, IPOs; Check Company Valuation, Earnings, Cash Flows, Debt

Investing in the stock market isn’t complicated, but if you are a first-time investor, remember to evaluate the company’s earnings, cash flows, valuation, debt, etc., before applying for IPOs and stocks.

Investing in the stock market isn’t complicated, but if you are a first-time investor, remember to evaluate the company’s earnings, cash flows, valuation, debt, etc., before applying for IPOs and stocks.

Start Investing Early To Take Benefit Of Power Of Compounding

Retirement planning will work in your favour if you start early. The monthly investment required to build the desired corpus will be much smaller because a longer term will allow your money to compound

Retirement planning will work in your favour if you start early. The monthly investment required to build the desired corpus will be much smaller because a longer term will allow your money to compound

Indian Market Remains Resilient Amid Global Economic Challenge, Says Neelesh Surana

The volatiltiy in the Indian equity market is making investors jittery about returns. But those who stick to their long-term goals will emerge winners, says Neelesh Surana, chief investment officer, Mirae Asset Investment Managers (India)

The volatiltiy in the Indian equity market is making investors jittery about returns. But those who stick to their long-term goals will emerge winners, says Neelesh Surana, chief investment officer, Mirae Asset Investment Managers (India)

No One Size Can Fit All

Each investor is unique and a specific individual’s reality may be vastly different from archetypal cases. Therefore, we can’t club everyone together

Each investor is unique and a specific individual’s reality may be vastly different from archetypal cases. Therefore, we can’t club everyone together

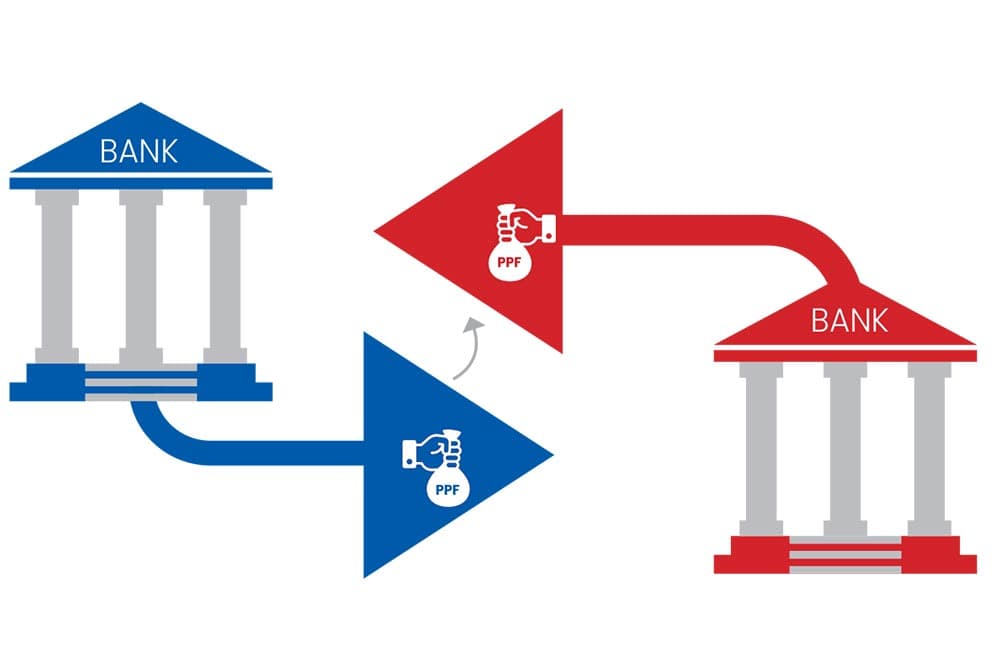

Here’s How To Transfer PPF Account To Another Bank

We give a step-by-step guide on how to move PPF to another bank

We give a step-by-step guide on how to move PPF to another bank

MF Recipe To Healthy Retirement

The average life expectancy in India has doubled since 1950s, and with the rising cost of living, mutual funds could be the medicine to ensure our funds outlive us

The average life expectancy in India has doubled since 1950s, and with the rising cost of living, mutual funds could be the medicine to ensure our funds outlive us

Tie Products To Your Needs

If you don’t invest in products suitable to your needs, your retirement goals will remain a dream, regardless of the fancy assets that you acquire

If you don’t invest in products suitable to your needs, your retirement goals will remain a dream, regardless of the fancy assets that you acquire

Digital Fraud: What Puts Seniors At Risk From And What They Can Do?

The elderly are more susceptible to digital frauds, but a little awareness and carefulness can keep them safe. Read on to know what can help them

The elderly are more susceptible to digital frauds, but a little awareness and carefulness can keep them safe. Read on to know what can help them

Will Mars Mean The Moon To Retirees?

The pension regulator’s MARS, which envisages delivering minimum assured returns, could give a new fillip to NPS by drawing more conservative investors into the scheme

The pension regulator’s MARS, which envisages delivering minimum assured returns, could give a new fillip to NPS by drawing more conservative investors into the scheme

NPS Exploring SWP Option For Lump Sum Withdrawals At Retirement: Deepak Mohanty

The New Pension System (NPS) has been clocking increased number of subscribers and a solid returns figure even as the debate on NPS versus the Old Pension Scheme (OPS) rages on.

The New Pension System (NPS) has been clocking increased number of subscribers and a solid returns figure even as the debate on NPS versus the Old Pension Scheme (OPS) rages on.

Right Product Fit Key to Success

Whether you fall in the category of FOMO or POMO, the true success of your investment portfolio lies in balancing the two. Hence, the right product fit and diversification are paramount

Whether you fall in the category of FOMO or POMO, the true success of your investment portfolio lies in balancing the two. Hence, the right product fit and diversification are paramount

Smoke & Mirrors: Scammed And Scarred, How Seniors Navigate Cyber Traps

Growing online scams targeting senior citizens highlight the gaps in the fight against cybercrimes, as lack of awareness, poor family support, and failure to nab criminals have worsened their misery. We tell you how seniors can soften the blows

Growing online scams targeting senior citizens highlight the gaps in the fight against cybercrimes, as lack of awareness, poor family support, and failure to nab criminals have worsened their misery. We tell you how seniors can soften the blows

Financial Freedom At 60

Four steps that can help you meet your expenses at retirement if you start investing a certain amount by a certain age. We have given calculations for four age-groups

Four steps that can help you meet your expenses at retirement if you start investing a certain amount by a certain age. We have given calculations for four age-groups

How Long To Ready, Aim, And Fire?

We have a quiz designed by Sebi-RIA Renu Maheshwari to help you assess your readiness to retire

We have a quiz designed by Sebi-RIA Renu Maheshwari to help you assess your readiness to retire

Buy Health Cover When You’re Young

In investing, starting early has a disproportionate impact on the overall outcome. The same holds true when planning for your health insurance in retirement. Start it while you are still young

In investing, starting early has a disproportionate impact on the overall outcome. The same holds true when planning for your health insurance in retirement. Start it while you are still young

Change Comes From Within

While individuals need to be cautious and vigilant but it’s also time for a policy change to come into effect to cater to the diverse needs of seniors

While individuals need to be cautious and vigilant but it’s also time for a policy change to come into effect to cater to the diverse needs of seniors

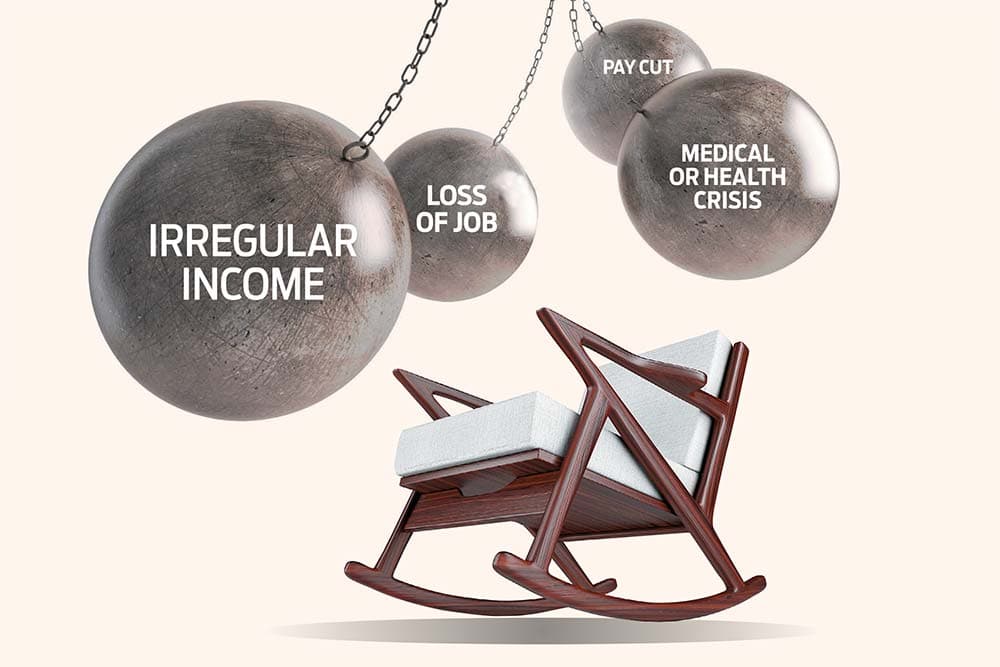

Beat Fear To Make A Smart Plan

Faulty planning is often a result of a conservative approach born out of fear and apprehension, and this heady concoction could wreak havoc on one’s financial requirements

Faulty planning is often a result of a conservative approach born out of fear and apprehension, and this heady concoction could wreak havoc on one’s financial requirements

What Is A Senior Citizen Savings Scheme? Know Tax, Eligibility, Maturity & More

Union Finance Minister Nirmala Sitharaman, in her 2023-24 budget speech, announced an increase in the maximum deposit limit for Senior Citizen Savings Scheme (SCSS) from 15 lakh to Rs 30 lakh.

Union Finance Minister Nirmala Sitharaman, in her 2023-24 budget speech, announced an increase in the maximum deposit limit for Senior Citizen Savings Scheme (SCSS) from 15 lakh to Rs 30 lakh.

How To Ensure Regular Cash Flow?

Retirement places one at a crucial fork in one’s life in terms of money management. That’s why its critical to choose the best way ahead for smooth cash flow

Retirement places one at a crucial fork in one’s life in terms of money management. That’s why its critical to choose the best way ahead for smooth cash flow

NPS Gives More Power To Pension Savers

NPS Gives More Power To Pension Savers

NPS Gives More Power To Pension Savers

How Much Should Retirees Withdraw?

Fixing a withdrawal rate that is in sync with rising inflation or scaling down one’s lifestyle are some of the options that individuals can exercise in their retirement years

Fixing a withdrawal rate that is in sync with rising inflation or scaling down one’s lifestyle are some of the options that individuals can exercise in their retirement years

Here’s How To Open An NPS Account

The National Pension System (NPS) is a voluntary, defined contribution pension vehicle that provides market-linked returns. NPS, regulated by the Pension Fund Regulatory and Development Authority (PFRDA), pays up to 60 per cent as lump sum after retirement and invests 40 per cent in annuities that pay regular pension. Any Indian citizen aged 18-65 years can open an NPS account.

The National Pension System (NPS) is a voluntary, defined contribution pension vehicle that provides market-linked returns. NPS, regulated by the Pension Fund Regulatory and Development Authority (PFRDA), pays up to 60 per cent as lump sum after retirement and invests 40 per cent in annuities that pay regular pension. Any Indian citizen aged 18-65 years can open an NPS account.

Annuities May Not Be The Answer

The important thing is to let your money work while you are still in your working years, so that you are free from financial dilemma in your retirement years

The important thing is to let your money work while you are still in your working years, so that you are free from financial dilemma in your retirement years

Make It About You

In a country that has scant social security, where families are becoming nuclear and there is a large machinery in the financial industry that is led by its own profit-making endeavours, the responsibility of retirement planning rests squarely on your own shoulders.

In a country that has scant social security, where families are becoming nuclear and there is a large machinery in the financial industry that is led by its own profit-making endeavours, the responsibility of retirement planning rests squarely on your own shoulders.

Mind The Mis-Selling Traps On The Path To Retirement

Senior citizens, especially new retirees with a substantial nest egg, are easy victims when it comes to mis-selling of financial products. Awareness and knowing how to spot the danger is the only way to protect yourself

Senior citizens, especially new retirees with a substantial nest egg, are easy victims when it comes to mis-selling of financial products. Awareness and knowing how to spot the danger is the only way to protect yourself

Retirement Planning: How to Prepare For The Last Milestone

However far retirement may appear to be, it’s important to start early and start now to accumulate an adequate corpus. If you have reached your golden years already and have a nest egg, make it work harder for you to ensure it lasts a lifetime

However far retirement may appear to be, it’s important to start early and start now to accumulate an adequate corpus. If you have reached your golden years already and have a nest egg, make it work harder for you to ensure it lasts a lifetime

Pointing In The Right Direction

Retirement-oriented mutual funds come in multiple variants that help in wealth creation, regular income generation and everything in between

Retirement-oriented mutual funds come in multiple variants that help in wealth creation, regular income generation and everything in between

NPS Will Offer More Flexible Investing Options

New changes are geared towards meeting retirement goals of today’s young investors, says PFRDA chairman Supratim Bandyopadhyay

New changes are geared towards meeting retirement goals of today’s young investors, says PFRDA chairman Supratim Bandyopadhyay

No One Perfect Plan

A good retirement plan covers all the issues that might be considered significant for the individual concerned, and not everyone

A good retirement plan covers all the issues that might be considered significant for the individual concerned, and not everyone

Make Your Sunset Years Cash Positive

A guide to determine how much you need for regular cash flow, post retirement

A guide to determine how much you need for regular cash flow, post retirement

Living On Her Own Terms

It’s natural for a single woman to wish to retire with financial independence. She needs better planning and smarter allocation to ensure a life without a support system

It’s natural for a single woman to wish to retire with financial independence. She needs better planning and smarter allocation to ensure a life without a support system

Seize The Day, My Friend!

After a 10-hour toil through the day, the 40-something man would go to sleep every night, clinching a dream. Fifteen more years of struggle and then a happy life with a lot of sun and smile.

After a 10-hour toil through the day, the 40-something man would go to sleep every night, clinching a dream. Fifteen more years of struggle and then a happy life with a lot of sun and smile.

Living With A Small Corpus

Never mind if you haven’t saved enough for your golden days. Use your passion and experience to build a strong portfolio to earn from it

Never mind if you haven’t saved enough for your golden days. Use your passion and experience to build a strong portfolio to earn from it

Light The #FIRE

Financial independence to retire early is the new millennial hack. Aim for freedom to pursue your passion

Financial independence to retire early is the new millennial hack. Aim for freedom to pursue your passion

Plan Early For Sunny Winter Of Life

Approach towards retirement is changing and so are the needs

Approach towards retirement is changing and so are the needs

Sailing Smoothly Through Sundown Years

Planning finances smartly is essential to support retirement years

Planning finances smartly is essential to support retirement years

Gift Of Annuity: A Truth For Every Professional?

Private sector employees might be entitled to monthly pension soon

Private sector employees might be entitled to monthly pension soon

Calling The Shots Embracing The Amber Years With Elan

Managing Money Beforehand Is Crucial To Survive The Winter Of Life

Managing Money Beforehand Is Crucial To Survive The Winter Of Life